The U.S. cryptocurrency scene is a complex and rapidly evolving landscape, with exchanges playing a pivotal role in the market’s expansion and stability. As digital assets gain traction, understanding the intricacies of these platforms becomes essential for both seasoned investors and newcomers. This article delves into the major exchanges, their impact on liquidity, regulatory challenges, and the emergence of global players like HashKey Group, while also providing essential tips for identifying secure and trustworthy exchanges.

Key Takeaways

- Crypto exchanges are crucial for market liquidity and accessibility, but not all are safe due to the rise of cybercrime and fraud.

- Regulatory compliance in the U.S. is complex, and exchanges must navigate a challenging landscape to operate legally.

- Coinbase’s expansion into Canada, with registration and bank partnerships, is shaping the Canadian crypto ecosystem.

- Bitcoin’s price surge and the approval of Bitcoin ETFs signal significant market trends, with altcoins also poised for growth.

- HashKey Group’s global expansion and strategic licensing underscore the increasing globalization of cryptocurrency services.

The Role of Crypto Exchanges in the Digital Asset Market

Understanding the Functionality of Crypto Exchanges

Cryptocurrency exchanges serve as the pivotal hubs of digital asset trading, offering a platform for users to buy and sell digital currencies like Bitcoin and Ethereum. Much like their traditional counterparts in the stock market, these exchanges provide the infrastructure necessary for the execution of trades, setting the stage for price discovery and market liquidity.

- Facilitate trading of various cryptocurrencies

- Provide market liquidity

- Enable price discovery

- Offer secure storage of digital assets

Cryptocurrency exchanges are not just marketplaces, but also serve as custodians of users’ digital assets, emphasizing the importance of robust security measures.

Selecting a reputable cryptocurrency exchange is crucial, as it directly impacts the safety of your investments and the overall trading experience. With the rise of cybercrime and fraud, understanding the inner workings and safety protocols of these platforms is essential for any investor.

The Impact of Exchanges on Cryptocurrency Liquidity

Cryptocurrency exchanges are pivotal in providing the necessary infrastructure for the fluid movement of digital assets. They act as a bridge between buyers and sellers, facilitating trades that determine the liquidity of various cryptocurrencies. High liquidity is essential for a healthy market, as it ensures that transactions can be executed swiftly and with minimal slippage.

- Liquidity pools: Exchanges aggregate funds to create deep markets.

- Order book depth: A measure of market liquidity, reflecting the volume of buy and sell orders.

- Trade volume: High volumes indicate a vibrant exchange with active trading.

Liquidity is not just about the volume of trades, but also the ease with which assets can be bought or sold without causing significant price movement.

The presence of multiple exchanges has led to a competitive landscape where platforms strive to offer the best prices, lowest fees, and innovative features to attract users. This competition benefits the end-users by providing more options and better service.

Regulatory Landscape for Crypto Exchanges in the U.S.

The regulatory environment for cryptocurrency exchanges in the United States is a complex and evolving landscape. Regulatory approvals have opened new avenues for institutional and retail investors, allowing for exposure to digital assets without the need to own the underlying cryptocurrencies directly.

- The Securities and Exchange Commission (SEC) plays a pivotal role in overseeing crypto exchanges.

- State-level regulations can vary significantly, adding layers of complexity for exchanges operating across the country.

- Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is mandatory for operating legally.

The intricacies of U.S. regulations create a challenging environment for crypto exchanges, but they also provide a structured framework aimed at protecting investors.

The debate continues on the balance between innovation and consumer protection, with some arguing that stringent regulations may push investors towards less regulated platforms. As the market matures, the regulatory framework is expected to adapt, potentially paving the way for more exchange traded products and a broader acceptance of digital assets.

Identifying and Avoiding Unsafe Crypto Exchanges

Red Flags to Watch Out for in Crypto Platforms

When venturing into the world of cryptocurrency trading, it’s crucial to be vigilant about the platforms you use. Not all exchanges prioritize user security, and some may expose you to unnecessary risks. Here are some red flags to consider:

- Lack of transparency: If an exchange is not open about its ownership, location, or the team behind it, this could be a cause for concern.

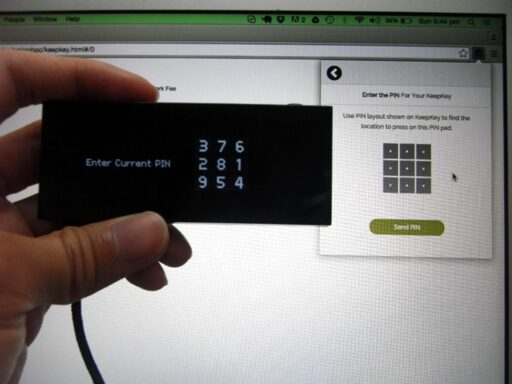

- Inadequate security measures: A platform that doesn’t offer two-factor authentication (2FA) or has a history of security breaches should be avoided.

- Unrealistic promises: Be wary of platforms offering guaranteed returns or extremely low fees that seem too good to be true.

- Poor user reviews: Consistent negative feedback from users can be a telling sign of an exchange’s reliability.

It’s essential to conduct thorough research and due diligence before committing to any crypto exchange. Remember, the safety of your investments should always come first.

Security Measures to Expect from Reputable Exchanges

When venturing into the world of digital assets, the security of your investments should be paramount. Reputable crypto exchanges prioritize robust security protocols to safeguard users’ funds and personal information. These measures are not just a courtesy but a necessity in an industry that’s a frequent target for cybercriminals.

Key security features to expect include:

- Two-factor authentication (2FA)

- Cold storage of the majority of funds

- Encryption of sensitive data

- Regular security audits by third-party firms

- Insurance policies to protect against theft or hacking

It’s essential to verify that an exchange implements these security measures before you commit to using their services. The 2023 Buyer’s Guide emphasizes the importance of security, alongside factors like regulatory compliance and market liquidity, when selecting top crypto exchanges in the USA.

By ensuring that an exchange employs comprehensive security measures, you can significantly reduce the risk of falling victim to cyber threats and enjoy a more secure trading experience.

User Reviews and Community Trust: A Barometer for Safety

In the digital age, user reviews and community trust play a pivotal role in assessing the safety and reliability of crypto exchanges. Websites like Trustpilot offer a platform for customers to share their experiences, providing valuable insights into the service quality of exchanges like BTCC.

The collective voice of the community often highlights the strengths and weaknesses of a platform, serving as an informal audit of its performance and trustworthiness.

When considering a crypto exchange, it’s crucial to look beyond the surface. A bulleted list can help identify key aspects to scrutinize:

- Customer service responsiveness

- Frequency of technical issues

- Transparency of fee structures

- Security breach history

- Ease of fund withdrawal

These factors, when combined with user testimonials, paint a comprehensive picture of an exchange’s standing within the community.

Coinbase’s Expansion and Influence in North America

Coinbase’s Registration and Operations in Canada

Coinbase’s expansion into Canada marks a significant milestone for the company and the broader cryptocurrency market in North America. Coinbase filed for the operating license in Ontario in March 2023 and has since been officially registered as a Restricted Dealer. This registration allows Coinbase to operate legally within the Canadian jurisdiction, where it has already established a substantial presence with a staff of 200 employees in Toronto.

The Canadian authorities’ decision to grant Coinbase the opportunity to operate in the country is a testament to the exchange’s compliance efforts and its status as a major player in the crypto space. Negotiations with major Canadian banks are underway, aiming to secure their support and foster the growth of the crypto ecosystem in Canada.

Coinbase’s entry into the Canadian market is not just about business expansion; it’s about shaping the future of digital assets in a country that is increasingly open to innovation in the financial sector.

Partnerships with Canadian Banks and Their Impact

Coinbase’s foray into the Canadian market has been marked by its official registration as a Restricted Dealer, a significant milestone that underscores the exchange’s commitment to compliance and growth within the region. The collaboration with major Canadian banks is poised to bolster the crypto ecosystem in Canada, providing a more integrated financial landscape for digital assets.

The partnerships are expected to yield several benefits:

- Enhanced liquidity for cryptocurrency transactions

- Improved access to crypto-related services for Canadian customers

- Strengthened trust and credibility for Coinbase in the Canadian market

These strategic alliances signify a pivotal step towards mainstream acceptance of cryptocurrencies in Canada, potentially setting a precedent for other financial institutions.

Coinbase’s negotiations with Canadian banks are not just about expanding its operational footprint; they are about creating a robust infrastructure that supports the burgeoning demand for cryptocurrencies. As these partnerships materialize, they could pave the way for a more seamless and secure crypto experience for users across the country.

Coinbase’s Role in Shaping the Canadian Crypto Ecosystem

Coinbase’s entry into the Canadian market marks a significant milestone for the country’s digital asset landscape. Officially registered as a Restricted Dealer, Coinbase’s presence in Canada is not just a testament to its global reach but also to the evolving regulatory environment that is beginning to embrace cryptocurrency exchanges.

Coinbase’s negotiations with major Canadian banks signal a potential shift in the financial ecosystem, with traditional institutions recognizing the importance of integrating with the crypto economy. This collaboration could lead to enhanced services for Canadian users, including easier access to cryptocurrencies and more seamless fiat-to-crypto transactions.

The strategic partnerships and regulatory achievements of Coinbase in Canada are indicative of the exchange’s influence in shaping the local crypto ecosystem. These developments could pave the way for increased adoption and innovation within the Canadian market.

Cryptocurrency exchanges like Binance, Coinbase, and Kraken dominate the market with high trading volumes, unique features, and strong security measures, catering to diverse investor needs. In Canada, Coinbase’s efforts to align with banks and navigate the regulatory landscape underscore its commitment to fostering a robust and secure environment for cryptocurrency trading.

Emerging Trends in the Cryptocurrency Market

Bitcoin’s Price Surge and Market Dynamics

The recent surge in Bitcoin’s price to $72,000 has been a focal point for market analysts and investors alike. This significant increase has been attributed to a confluence of factors, including macroeconomic influences and the anticipation of Bitcoin halving events. However, the market dynamics are complex, with traditional financial indicators like the Dollar Index playing a pivotal role.

- The Dollar Index’s rise above 104 points presents a challenge for Bitcoin’s upward momentum.

- External factors, such as traditional market forces, could potentially restrain Bitcoin’s growth.

- Despite these hurdles, there remains potential for Bitcoin’s price to ascend further.

In the midst of these market conditions, Bitcoin has managed to push past significant price thresholds, suggesting a robust demand and investor optimism. Yet, the market is not without its uncertainties, and volatility is expected to increase as pivotal moments for Bitcoin approach.

The interplay between Bitcoin’s intrinsic market movements and external economic indicators will continue to be a critical area of focus for those navigating the cryptocurrency landscape.

The Significance of Bitcoin Halving and ETF Approvals

The Bitcoin halving is a pivotal event in the cryptocurrency world, reducing the reward for mining new blocks by 50% and historically triggering a price surge. However, the anticipated impact of halving may be changing. Experts suggest that the market may not experience the same bullish effect as in previous cycles, potentially due to the early arrival of Bitcoin’s all-time high (ATH) before the halving, influenced by the excitement around spot ETFs.

The introduction of Bitcoin spot ETFs, approved by the SEC on January 10, 2024, represents a significant milestone for the U.S. crypto market. It not only signals regulatory acceptance but also opens the doors for institutional investors to participate more actively in the market.

Despite some skepticism, the combination of halving and ETF approvals could still propel Bitcoin to new heights. ETFs are already purchasing over $200 million in shares daily, exerting a considerable influence on market liquidity and supply. Whether this will culminate in Bitcoin reaching the elusive $100,000 mark remains a topic of debate among analysts.

Altcoins to Watch: Predictions for the Next Big Cryptos

As the crypto market evolves, investors are on the lookout for the next big altcoins that could follow Bitcoin’s explosive growth. The second quarter of 2024 has already seen Bitcoin shatter records, and with the Bitcoin halving event on the horizon, altcoins are gaining increased attention.

The diversity of the cryptocurrency market is evident in the range of altcoins coming to the forefront. From meme coins to platforms focusing on decentralized finance (DeFi) and artificial intelligence (AI), the potential for significant growth is vast.

Here’s a snapshot of altcoins that are making waves in the market:

- Dogecoin20 (DOGE20): A new meme coin with a fixed supply and a commitment to sustainable tokenomics.

- Virtuality Coin (VRC): Powering virtual reality platforms, this coin is tapping into the burgeoning VR market.

- Liquid Ledger (LQL): Aiming to revolutionize decentralized liquidity solutions.

- AI Network (AIN): Focused on integrating AI technology within the blockchain ecosystem.

These altcoins represent just a slice of the dynamic and multifaceted crypto scene. As we delve into the in-depth exploration of the cryptocurrency world, it’s clear that the landscape is constantly shifting, with new tokens and technologies emerging regularly.

Global Expansion of Crypto Services: The Case of HashKey Group

HashKey Global: A New Player in the Exchange Arena

With the introduction of HashKey Global, the HashKey Group has marked a significant entry into the global cryptocurrency exchange market. This strategic move signifies the Group’s commitment to regulatory compliance and market innovation. The Bermuda license acquisition is a testament to their dedication to adhering to international standards and providing secure trading services to a diverse clientele.

The launch of HashKey Global is not just about geographical expansion; it’s about offering a comprehensive suite of services to meet the needs of various market participants. From qualified retail users to seasoned investors, the platform aims to cater to the full spectrum of cryptocurrency enthusiasts.

The establishment of HashKey Global is poised to set a new benchmark in the cryptocurrency exchange sector, promoting international expansion and a robust service offering.

As the crypto industry continues to evolve, with topics like altcoins, Bitcoin, blockchain, DeFi, NFTs, and more at the forefront, HashKey Global’s emergence is a clear indication of the dynamic nature of the market and the continuous need for platforms that can keep pace with its rapid growth.

The Strategic Importance of Securing Licenses

Securing the necessary licenses is a pivotal step for any crypto exchange aiming to gain legitimacy and trust in the global market. For HashKey Group, obtaining a license in Bermuda is a testament to their commitment to compliance and market innovation. This move not only broadens their operational reach but also instills confidence among investors and users seeking a secure trading environment.

The acquisition of the Bermuda license is a strategic milestone for HashKey Group, enabling them to offer a comprehensive range of digital asset services within a regulated framework.

The significance of this licensing extends beyond mere regulatory compliance; it is about creating a robust platform that assures users of the safety and integrity of their investments. Here are some of the services that HashKey Group can now offer thanks to the Bermuda license:

- Launchpad services

- Futures trading

- Leveraged trading

With licenses already secured in Japan, Hong Kong, and Singapore, HashKey Group is rapidly establishing itself as a leader in the licensed exchange services sector. Their vision to create one of the largest licensed exchange clusters in the world within the next five years is ambitious, and the Bermuda license is a crucial step towards achieving this goal.

How HashKey Group is Reshaping the Global Crypto Landscape

The launch of HashKey Global marks a pivotal shift in the cryptocurrency exchange domain. HashKey Group’s strategic acquisition of a Bermuda license paves the way for its international expansion, setting a new standard in the exchange sector. This move signifies the company’s dedication to regulatory compliance and its ambition to innovate within the market.

- Secured a crucial Bermuda license

- Targeting a global clientele

- Committed to regulatory compliance

- Focused on market innovation

HashKey Group’s global approach is not just about widening its operational reach; it’s about creating a robust platform that caters to the diverse needs of cryptocurrency enthusiasts worldwide.

By diversifying its offerings, HashKey Global is poised to attract a wide range of market participants, from seasoned investors to qualified retail users. The company’s commitment to providing compliant trading services is a testament to its foresight in navigating the complex regulatory environment that surrounds digital assets.

Conclusion

As we’ve navigated the complex landscape of the U.S. crypto scene, it’s clear that the choice of exchange is paramount to a secure and prosperous digital asset experience. From the rise of major players like Coinbase, which has expanded its reach into Canada, to the innovative platforms emerging in the market, such as HashKey Global, investors have a wealth of options at their disposal. However, the journey doesn’t end with selection; vigilance is key in an industry where the risks of cybercrime and fraud loom large. By staying informed and cautious, as outlined in guides like those by Gianluca Longinotti, users can engage with the crypto economy confidently. With the cryptocurrency market continuing its bullish trend and regulatory milestones like the SEC’s approval of Bitcoin ETFs, the future looks bright for those who navigate these waters with care and due diligence.

Frequently Asked Questions

What role do crypto exchanges play in the digital asset market?

Crypto exchanges are crucial for the digital asset market as they provide a platform for users to buy, sell, and trade cryptocurrencies, contributing to the liquidity and accessibility of digital assets.

How can I identify an unsafe crypto exchange?

To spot an unsafe crypto exchange, look for red flags such as lack of transparency, inadequate security measures, poor user reviews, and a history of security breaches or regulatory issues.

What security measures should reputable crypto exchanges have?

Reputable crypto exchanges should have robust security measures like two-factor authentication (2FA), encryption, cold storage for funds, regular security audits, and compliance with relevant regulations.

How does Coinbase’s expansion impact the Canadian crypto ecosystem?

Coinbase’s expansion into Canada, including its registration and partnerships with Canadian banks, strengthens the country’s crypto ecosystem by providing a reputable platform for trading and fostering industry growth.

What are the upcoming trends in the cryptocurrency market for 2024?

In 2024, significant trends include Bitcoin’s price surge, the impact of the Bitcoin halving event, SEC’s approval of Bitcoin ETFs, and the rise of new altcoins that investors should watch.

What is the significance of HashKey Group’s global expansion?

HashKey Group’s global expansion, marked by the launch of HashKey Global and securing important licenses, is significant as it contributes to the reshaping of the global crypto landscape and offers new services to users worldwide.