Cryptocurrency mining stands at the core of the decentralized nature of digital currencies like Bitcoin and Ethereum. It’s a complex process that involves validating transactions and creating new units of currency. As cryptocurrencies continue to gain popularity and adoption, understanding the intricacies of mining is crucial. This guide aims to demystify the mechanics of crypto mining, providing a comprehensive look at its fundamentals, technical processes, economic implications, and future outlook.

Key Takeaways

- Crypto mining is essential for transaction validation and new currency creation, maintaining the decentralized blockchain network.

- Understanding mining setups, including hardware choices and software configurations, is crucial for effective and profitable mining operations.

- The profitability of crypto mining is influenced by factors like mining difficulty, block rewards, energy costs, and market volatility.

- Emerging technologies and regulatory challenges are shaping the future landscape of crypto mining, requiring miners to stay informed and adaptable.

- Despite its complexities, crypto mining offers opportunities for individuals and businesses to contribute to the growth and security of cryptocurrencies.

Decoding the Fundamentals of Crypto Mining

Understanding the Core: What is Crypto Mining?

At the heart of the blockchain revolution is crypto mining, a process that is both the backbone of cryptocurrency networks and a gateway to their expansion. Crypto mining is the mechanism by which transactions are verified and added to the public ledger, known as the blockchain. It is also the means through which new coins are released.

Crypto mining involves participants using powerful computers to solve complex mathematical puzzles. The first miner to crack the puzzle gets the right to add a new block to the blockchain and is rewarded with cryptocurrency.

The significance of mining extends beyond transaction verification; it is integral to the security and integrity of the blockchain. By requiring miners to provide proof of work, the network ensures that altering the blockchain is computationally demanding, deterring potential attackers.

- Security: Mining contributes to the robustness of the blockchain by making it costly and difficult to attack.

- Decentralization: It allows for a decentralized control of the cryptocurrency, as opposed to a central authority.

- Currency Issuance: Mining is the process through which new units of cryptocurrency are created and distributed.

Understanding these core functions of crypto mining is essential for anyone looking to grasp the inner workings of cryptocurrencies and their underlying technologies.

The Role of Miners in the Cryptocurrency Ecosystem

Miners are the backbone of the cryptocurrency world, providing the computational power necessary to maintain and secure the blockchain. They validate and record transactions, ensuring the integrity of the cryptocurrency ledger. This process, known as proof of work, requires miners to solve complex mathematical problems, which in turn adds new blocks to the blockchain.

- Decentralization: Miners contribute to the decentralized nature of cryptocurrencies, preventing any single entity from gaining control over the network.

- Block Creation: By mining, new blocks are added to the blockchain, which includes recording transactions and minting new cryptocurrency units.

- Security: The collective effort of miners makes the blockchain resistant to fraud and cyber-attacks.

Miners play a pivotal role in the cryptocurrency ecosystem, not just in transaction verification but also in the creation of new digital currency units and the overall security of the system. Their continuous effort underpins the trust and functionality of cryptocurrencies.

Understanding the role of miners is crucial for anyone looking to grasp the full scope of cryptocurrency operations. From ensuring the system’s decentralization to securing the network, miners’ contributions are indispensable. As the cryptocurrency landscape evolves, the importance of miners remains constant, making them integral to the digital currency’s future.

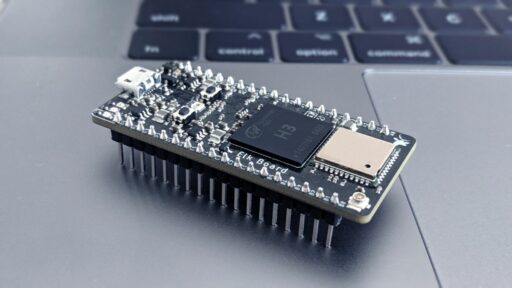

Key Components of a Mining Setup

Setting up a mining rig is a critical step in the journey of cryptocurrency mining. Selecting the right components is vital for both performance and efficiency. A mining rig typically comprises several key elements:

- Graphics Processing Unit (GPU) or Application-Specific Integrated Circuit (ASIC): These are the heart of the mining operation, providing the necessary computational power.

- Motherboard: It’s the backbone that connects all components, with multiple GPU support being a crucial feature.

- Power Supply Unit (PSU): A robust PSU ensures your rig has enough power, with efficiency and reliability being key considerations.

- Cooling System: Adequate cooling is essential to maintain performance and prevent hardware damage.

- Mining Software: The bridge between your hardware and the blockchain, this software manages the mining process.

Cryptocurrency mining involves complex processes like hardware selection, rig assembly, and software optimization for efficiency and profitability. Diversifying investments through staking is also recommended.

The Technical Blueprint: How Crypto Mining Works

The Process of Transaction Verification

In the realm of cryptocurrency mining, the verification of transactions is a critical step that precedes the actual mining of a new block. Miners gather unconfirmed transactions from the network’s mempool, a holding area for all pending transactions, and begin the rigorous task of validation. This process includes checking the mathematical balance of inputs and outputs, as well as the authenticity of digital signatures, which proves ownership without compromising privacy.

The validation process is not only about maintaining mathematical accuracy but also about ensuring the security of the network. Miners must confirm that each transaction is legitimate, preventing fraudulent activities such as double-spending. Once a transaction passes these checks, it is deemed valid and can be included in a new block, which is then attached to the blockchain upon successful mining.

The integrity of cryptocurrency transactions is upheld through this meticulous verification process, which is fundamental to the trust and functionality of the blockchain network.

The following list outlines the key steps in transaction verification:

- Ensuring that the sum of inputs equals the sum of outputs plus transaction fees.

- Verifying the correctness of digital signatures to confirm ownership.

- Checking for double-spending to guarantee that each coin is spent only once.

- Assembling verified transactions into a new block for the blockchain.

Hashing and the Proof-of-Work Algorithm

In the realm of crypto mining, hashing is a fundamental process that transforms an input of any length into a fixed-size string of characters, which appears random. Each hash is unique; even the slightest change in the input data will produce a vastly different hash output. This property is crucial for maintaining the integrity of the blockchain, as it ensures that any alteration of transaction data is easily detectable.

Proof of Work (PoW), on the other hand, is the mechanism that underpins the security of many cryptocurrencies, including Bitcoin. Miners must solve complex cryptographic puzzles, which require significant computational power and energy. The first miner to find the solution, or the correct hash, is granted the privilege to add a new block to the blockchain and is rewarded with cryptocurrency. This process not only secures the network but also introduces new coins into circulation.

The PoW algorithm is a testament to the decentralized nature of cryptocurrencies, where trust is established not through central authorities but through computational work and consensus among network participants.

The competition among miners to solve these puzzles is fierce, as the rewards can be substantial. However, this also means that the energy consumption associated with mining is considerable, raising concerns about sustainability and the environmental impact of cryptocurrencies.

Mining Difficulty and Block Rewards

Mining difficulty is a critical component that ensures the stability and security of the blockchain. It adjusts to maintain a consistent interval between the creation of each block. As the collective computational power of miners increases, so does the difficulty, making it harder to find the correct hash and successfully mine a block. This mechanism prevents the rapid mining of all available coins and maintains the currency’s value.

Block rewards are the incentive for miners to contribute their processing power to the network. These rewards consist of newly minted coins and transaction fees from the transactions included in the new block. Over time, the block reward decreases due to an event known as halving, which reduces the reward by half at predetermined intervals. This event ensures the scarcity of the cryptocurrency, further influencing its value.

Crypto mining profitability relies on network difficulty and block rewards. Miners must understand these factors, diversify portfolios, and stay informed for long-term success.

Understanding the dynamic between mining difficulty and block rewards is essential for miners aiming to achieve profitability. Here’s a list of factors affecting mining profitability:

- Hash rate

- Block rewards

- Mining difficulty

- Electricity and power consumption costs

- Mining pool fees

- Market price of the cryptocurrency

Diving into Mining Methods: Varieties and Viability

Solo Mining vs. Pool Mining: Pros and Cons

In the realm of cryptocurrency mining, individuals face a choice between solo mining and pool mining, each with its distinct advantages and challenges. Solo mining is an independent venture, offering miners complete control over their operations and the potential for larger individual rewards. However, it requires significant investment in powerful hardware and comes with a high risk of fruitless efforts due to the competitive nature of mining.

On the other hand, pool mining is a collaborative effort where miners combine their computational resources to improve their chances of successfully mining blocks. While this method offers more frequent rewards and reduced costs, it also means sharing the spoils with other pool members.

- Solo Mining Pros:

- Full control and autonomy

- No need to share rewards

- Potential for larger payouts

- Solo Mining Cons:

- High initial investment

- Lower probability of success

- Intense competition

- Pool Mining Pros:

- Shared resources reduce costs

- Higher success rates

- More consistent rewards

- Pool Mining Cons:

- Smaller individual rewards

- Dependence on pool’s success

- Possible pool fees

The decision between solo and pool mining ultimately hinges on the miner’s resources, risk tolerance, and goals. While solo mining can be likened to a solitary treasure hunt, pool mining is a team effort where success and rewards are a collective endeavor.

Cloud Mining: Outsourcing the Effort

Cloud mining represents a shift in the cryptocurrency mining paradigm, allowing individuals to participate in mining activities without the need for substantial hardware investments. Cloud mining services rent out their computing power to users, who can mine cryptocurrencies by paying a fee, similar to utility bills for services like electricity or water. This model has gained traction as the cost of solo mining has skyrocketed, making it less accessible for the average person.

The allure of cloud mining lies in its simplicity and accessibility. Users can engage in mining by simply signing up for a service, selecting a mining plan, and paying the associated fees. The mining operations are carried out by the service provider’s infrastructure, which means that users do not have to deal with the complexities of setting up and maintaining mining hardware.

Despite its convenience, cloud mining comes with its own set of challenges. Users must carefully evaluate the legitimacy and profitability of cloud mining services to avoid scams and ensure a return on their investment.

When considering cloud mining, it’s crucial to research and compare different providers. Factors such as reputation, contract terms, and customer support should be taken into account. For instance, companies like Binance have launched reputable cloud mining services, reflecting the growing sophistication of the crypto mining industry.

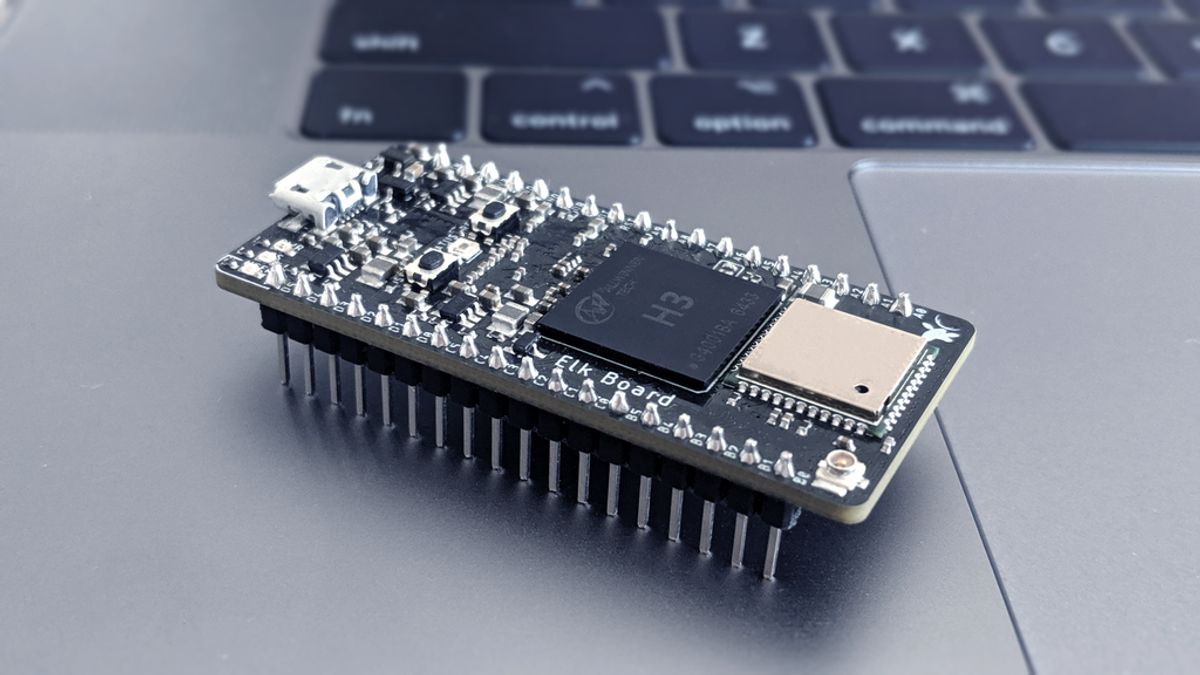

ASIC, GPU, and CPU Mining: Choosing Your Hardware

When venturing into the realm of crypto mining, selecting the appropriate hardware is a pivotal decision that can significantly influence your mining efficiency and profitability. The evolution of mining hardware from CPU to ASICs has been driven by the relentless pursuit of higher hashing power and energy efficiency. Initially, miners used CPUs, the central processing units of computers, but as the complexity of mining increased, GPUs, or graphics processing units, became the standard due to their superior computational abilities.

However, the current pinnacle of mining technology is the ASIC, or Application-Specific Integrated Circuit. These devices are engineered exclusively for mining and offer unparalleled hashing rates. Despite their prowess, ASICs come with high costs and substantial power requirements. GPUs, while less powerful than ASICs, still retain relevance for certain cryptocurrencies and provide a more versatile option for miners.

Choosing the right equipment is crucial for profitability and success in crypto mining.

Here’s a quick comparison to help you understand the key differences:

- ASIC Miners: High hash rates, significant investment, and power consumption.

- GPUs: More affordable, versatile, but less efficient than ASICs.

- CPUs: Mostly obsolete for mining, used for system operations and software communication.

Economic Aspects of Crypto Mining

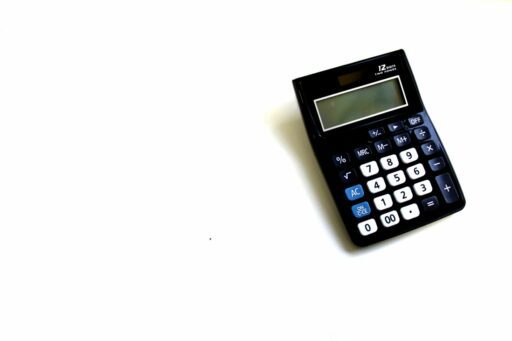

Calculating Profitability: Investment vs. Return

When venturing into the realm of crypto mining, one of the most critical calculations is determining the potential profitability. Calculating the return on investment (ROI) is pivotal to understanding whether the mining operation can be financially viable. The formula for calculating ROI is (revenue – cost) / cost x 100, which takes into account the revenue generated from mined cryptocurrencies against the initial and ongoing costs.

To accurately assess profitability, consider the following factors:

- Current market prices of cryptocurrencies

- Mining difficulty levels

- Hardware costs and efficiency

- Electricity and cooling expenses

It is essential to use tools like CoinWarz and WhatToMine for a more comprehensive analysis, as they factor in your specific hardware and electricity rates to estimate potential earnings.

Remember that profitability is not static; it fluctuates with market conditions. Electricity costs, for instance, can significantly impact your bottom line. Additionally, the mining difficulty tends to increase over time, which can reduce the rate at which you earn rewards. Market volatility is another crucial aspect, as the value of cryptocurrencies can dramatically change, affecting the potential return.

Energy Consumption and Sustainability Concerns

The environmental impact of crypto mining is a growing concern, particularly due to its significant energy requirements. A recent White House report indicates that global electricity consumption for mining activities is estimated to be between 120 and 240 billion kilowatt-hours annually. This staggering figure exceeds the total energy usage of entire nations such as Argentina or Australia.

The energy-intensive nature of mining, especially with proof-of-work protocols, necessitates a shift towards more sustainable practices. Stakeholders are increasingly considering renewable energy sources and energy-efficient hardware to mitigate the adverse effects on the environment.

The push for sustainability is also evident in the exploration of alternative consensus mechanisms, like proof-of-stake, which require less energy. Ethereum’s transition to Ethereum 2.0 is a testament to this shift, aiming to reduce the platform’s carbon footprint. However, the future of mining remains uncertain as the industry grapples with balancing efficiency, cost, and environmental ethics.

The Impact of Market Volatility on Mining

The inherent volatility of cryptocurrency prices is a double-edged sword for miners. When the market soars, mining becomes exceedingly profitable, often resulting in a quick return on investment. Conversely, a market downturn can render mining unprofitable, as the cost of electricity and hardware may not be offset by the diminished value of mining rewards.

Market volatility demands a high degree of adaptability from miners. Those who can swiftly adjust their operations in response to market changes are more likely to sustain profitability.

To navigate these turbulent waters, miners often employ a variety of strategies:

- Monitoring market trends to inform mining activities.

- Diversifying mining operations across different cryptocurrencies.

- Adjusting electricity consumption during periods of low profitability.

- Hedging against market downturns with alternative investments.

Understanding and preparing for market volatility is crucial for maintaining a viable mining operation in the long term.

Navigating the Future Landscape of Crypto Mining

Emerging Technologies and Innovations

The relentless pursuit of efficiency and scalability in crypto mining has given rise to a host of emerging technologies and innovations. These advancements are not only enhancing the capabilities of mining hardware but are also introducing new paradigms in mining algorithms and protocols.

The integration of sustainable practices into mining operations is becoming increasingly important, as the industry seeks to balance innovation with environmental responsibility.

Among the most notable developments is the evolution of mining technology, which includes the transition from CPU to GPU, and now to ASIC technology. ASICs, being highly specialized and efficient, are now the standard for mining dominant cryptocurrencies like Bitcoin. However, the industry continues to adapt, with potential trends pointing towards further specialization and the adoption of environmentally friendly mining solutions.

- Evolution of mining hardware

- Advanced mining algorithms

- Sustainable mining practices

- Regulatory and market dynamics

Sunminer’s role in the future of mining is particularly highlighted, as they continue to push the boundaries of what’s possible with their cutting-edge solutions.

Regulatory Challenges and Legal Compliance

The crypto mining industry faces increasing regulatory scrutiny globally, with a patchwork of laws and regulations that miners must navigate. This evolving landscape demands that miners not only comply with current regulations but also stay agile to adapt to new legislative changes.

Miners are required to address a variety of concerns, from anti-money laundering (AML) and tax evasion to consumer protection. The table below summarizes key areas of compliance that miners must consider:

| Compliance Area | Description |

|---|---|

| AML Laws | Preventing the use of mining operations for money laundering. |

| Tax Obligations | Reporting and paying taxes on mining profits. |

| Consumer Protection | Ensuring the security and privacy of users’ data. |

Miners must also focus on eco-friendly mining solutions for sustainability, as environmental concerns are increasingly influencing regulatory policies.

Regulatory compliance is not just about adhering to the rules; it’s a strategic factor that can impact profitability, operational costs, and the geographic distribution of mining activities. As the regulatory environment tightens, miners must be proactive in their approach to legal compliance.

Predictions for the Evolution of Mining Practices

The landscape of crypto mining is poised for continuous transformation. Technological advancements are expected to drive significant changes in both hardware and software, leading to more efficient and scalable mining operations. The evolution of mining technology will likely see the introduction of next-generation mining rigs that are not only more powerful but also more energy-efficient.

Sustainability is becoming a central theme in the mining narrative. A shift towards more sustainable mining practices is anticipated, with the industry exploring renewable energy sources and innovative cooling techniques to reduce the environmental impact. This trend aligns with the broader societal push for eco-friendly initiatives.

The future of crypto mining will be shaped by the delicate balance between profitability and sustainability, with miners seeking to optimize both aspects in a rapidly evolving market.

As the industry matures, we can expect a continued move away from casual mining towards more specialized and professional operations. The role of miners is evolving, reflecting the importance and challenges of sustaining blockchain networks. Here are some potential developments to watch for:

- Introduction of advanced mining algorithms and protocols

- Increased adoption of Application-Specific Integrated Circuits (ASICs)

- Regulatory developments influencing mining operations

- Market dynamics impacting profitability and accessibility

These predictions for the evolution of mining practices underscore the dynamic nature of the cryptocurrency mining sector, where innovation and adaptability remain key to success.

Conclusion

As we conclude this comprehensive guide, it’s evident that cryptocurrency mining is a complex yet rewarding endeavor that sits at the heart of the digital currency ecosystem. From the intricate mechanics of hashing and proof-of-work to the strategic considerations of hardware selection and pool participation, mining is both an art and a science. For those willing to invest the time and resources, mining offers a unique opportunity to contribute to the security and vitality of blockchain networks while potentially earning rewards. Whether you’re just starting out or looking to refine your mining operations, staying abreast of the latest trends and technologies is crucial in this dynamic field. We hope this guide has illuminated the path for aspiring miners and provided a solid foundation for your journey into the world of crypto mining.

Frequently Asked Questions

What is cryptocurrency mining and how does it work?

Cryptocurrency mining is the process by which new coins are created and transactions are verified and added to the blockchain ledger. It involves using computer power to solve complex mathematical puzzles, which validates transactions and secures the network.

What are the key components necessary for crypto mining?

The key components for crypto mining include a mining rig (which can be built with CPUs, GPUs, or ASICs), mining software, a stable internet connection, a cryptocurrency wallet, and access to a mining pool if you’re not mining solo.

What is the difference between solo mining and pool mining?

Solo mining is when an individual miner performs the mining operations alone and receives the entire reward if they find a block. Pool mining involves joining a group of miners to combine computational resources and share the rewards proportionally to the contributed processing power.

How does one calculate the profitability of crypto mining?

To calculate the profitability of crypto mining, you need to consider factors such as the cost of your mining hardware, electricity expenses, mining pool fees (if applicable), the current price of the cryptocurrency, and the network’s mining difficulty.

What impact does market volatility have on crypto mining?

Market volatility can significantly impact crypto mining profitability. When the price of a cryptocurrency fluctuates, it affects the value of the mining rewards. Miners must stay informed about market trends and adjust their strategies accordingly.

What are some emerging technologies that could influence the future of crypto mining?

Emerging technologies such as more energy-efficient mining hardware, advancements in blockchain protocols that reduce the computational intensity, and the integration of renewable energy sources are likely to influence the future landscape of crypto mining.