In this blog, we’ll explore the landscape of cryptocurrency exchanges in 2024, highlighting the platforms that have garnered the highest praise from Reddit users. With an emphasis on user experience, security, and transparency, we aim to guide both novice and seasoned traders to the best crypto exchanges that meet their individual needs. Discover the features that make these exchanges stand out and learn how to select the right one for your trading strategies.

Key Takeaways

- Coinbase is celebrated for its user-friendly interface and is considered the best crypto exchange in the U.S.A, especially for beginners.

- Security is paramount in the crypto exchange ecosystem, with the best platforms offering features like 2FA, cold storage, and insurance.

- Reddit users value transparency and low fees when evaluating crypto exchanges, with Coinbase noted for its clear fee structure.

- Liquidity and trading volume are crucial factors to consider, as they impact the efficiency of order execution and the tightness of spreads.

- Our methodology for selecting the top crypto exchanges includes extensive testing and review of trading volume, security measures, and user experiences.

Evaluating Top Crypto Exchanges: User Reviews and Security

User-Friendly Platforms According to Reddit

When it comes to user-friendly crypto exchanges, Reddit users often share their experiences and preferences. A common theme is the desire for a platform that simplifies the complexities of cryptocurrency trading, making it accessible to both beginners and seasoned traders.

Reddit’s discussions highlight several platforms that stand out for their ease of use:

- Coinbase: Often recommended for its intuitive interface and straightforward buying process.

- Binance: Praised for its comprehensive features while still maintaining user-friendliness.

- Kraken: Noted for robust security measures coupled with a clean user experience.

The key to a successful exchange is not just in the number of features it offers, but in how effectively it can cater to users of all levels.

While the platforms mentioned above are frequently cited, it’s important to remember that user-friendliness is subjective and can vary based on individual needs and preferences. Therefore, potential users are encouraged to conduct their own research, considering factors such as security, fees, and available cryptocurrencies.

Security Measures: A Must for Crypto Exchanges

In the realm of digital assets, security is paramount. Users must prioritize exchanges that not only offer a seamless trading experience but also provide robust security measures to safeguard their investments. To this end, a multi-faceted approach is essential.

The key to maintaining security is a combination of user vigilance and exchange integrity.

Here are some steps to enhance security:

- Opt for exchanges with strong security features like 2FA and cold storage.

- Regularly update passwords and enable two-factor authentication.

- Stay informed about the latest security practices and regulatory changes.

- Withdraw funds to a secure wallet when they are not actively being traded.

While platforms like Robinhood are integrating features to prioritize security and trust, users must remain cautious. Advanced trading strategies and tools, such as AI for market predictions, come with inherent risks. It is crucial to understand the security landscape and take proactive measures to protect digital assets.

Reddit’s Take on Exchange Transparency and Fees

Reddit users often emphasize the importance of understanding the fee structures of crypto exchanges. They highlight that while some platforms boast low trading fees, they may compensate with higher withdrawal and deposit fees. It’s crucial for traders to consider all potential costs to avoid surprises.

- Maker and taker fees

- Percentage-based fees

- Conversion fees

- Network fees

Reddit’s community also values transparency in fee policies. Exchanges like Binance, KuCoin, and Kraken are frequently mentioned for their relatively low fees, but Redditors advise to always check the latest fee schedules as they can change over time.

When selecting a crypto exchange, aligning with one that offers clear and detailed fee information can significantly enhance your trading experience.

Understanding the full spectrum of fees, including trading, withdrawal, deposit, and network fees, is essential. Users should also be aware of conversion fees when exchanging cryptocurrencies directly on the platform.

The Best Crypto Exchanges for Beginners and Experts

Coinbase: The Gateway for New Traders

Coinbase has established itself as the premier platform for those new to cryptocurrency, thanks to its intuitive and straightforward interface. The platform’s commitment to user-friendliness is evident in its easy purchase process and the availability of a mobile app, which allows users to trade and manage their portfolios on the go.

Security is a cornerstone of the Coinbase experience, with robust measures such as two-factor authentication and insurance for digital assets, ensuring peace of mind for traders. While the exchange fees are on the higher side, the trade-off comes in the form of high trading volumes and a suite of educational resources that benefit users of all levels.

Coinbase’s Earn program is particularly noteworthy, offering users the opportunity to earn cryptocurrencies by completing educational tasks, adding an extra layer of engagement and learning to the trading experience.

Despite its many advantages, it’s important to note that Coinbase is not available in all 50 states, which may influence the choice for some traders. For those who can access it, however, Coinbase’s features and availability in more countries make it a top recommendation for entering the crypto market.

Advanced Trading Features for Seasoned Investors

Seasoned investors seek out exchanges that offer advanced trading features to enhance their strategies and optimize investment opportunities. These platforms typically support a variety of order types, catering to sophisticated trading strategies.

- Advanced trading options for informed decision-making

- Variety of order types for complex strategies

- Strict KYC and 2FA security protocols

Regulated exchanges ensure compliance with AML and CFT standards, providing a secure environment for high-volume trading.

For example, some exchanges implement features like instant buy or copy trading, which can be particularly attractive for investors looking to diversify their approach. It’s crucial to choose a platform that not only offers advanced tools but also prioritizes security and regulatory compliance.

Comparing User Experiences Across Different Platforms

When selecting a crypto exchange, user experience is a critical factor that can significantly influence trader satisfaction and platform loyalty. Reddit users often highlight the importance of intuitive interfaces and responsive customer support.

- eToro is frequently mentioned for its social trading features, allowing beginners to follow the trades of experienced investors.

- CryptoCompare provides comprehensive insights, making it a valuable educational resource for traders of all levels.

- CoinDesk is recognized for its real-time data and analysis, aiding users in making informed decisions.

While each platform has its unique strengths, traders should consider their individual needs and preferences when choosing an exchange.

The table below summarizes key aspects of user experience across different platforms:

| Platform | User Interface | Customer Support | Educational Resources |

|---|---|---|---|

| eToro | Intuitive | Responsive | Social Trading |

| CryptoCompare | Detailed | Community-Driven | Comprehensive Analysis |

| CoinDesk | Real-Time Data | Industry-Leading | In-Depth Reports |

Understanding the Crypto Exchange Ecosystem

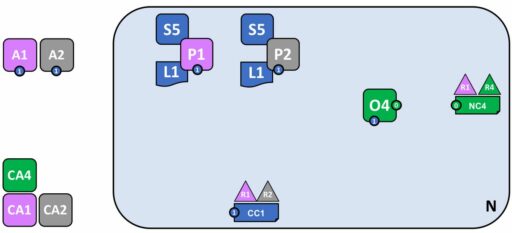

Types of Crypto Exchanges and Their Operations

Cryptocurrency exchanges are pivotal in the digital currency ecosystem, providing a platform for users to buy, sell, or trade cryptocurrencies. The core functionality of these exchanges is to match buy and sell orders, ensuring a seamless transaction process for various digital currencies or fiat money.

- Centralized Exchanges (CEXs): Operated by a central authority, they offer fast order processing and high liquidity but are often criticized for their vulnerability to hacking.

- Decentralized Exchanges (DEXs): Run on blockchain technology, enabling peer-to-peer trading without a central authority, thus enhancing security and privacy.

- Hybrid Exchanges: Aim to offer the best of both worlds by combining the efficiency of CEXs with the security of DEXs.

In addition to basic trading services, some exchanges expand their offerings to include margin trading, futures trading, and access to ICOs or token sales, each with its own fee structure.

When selecting a crypto exchange, it’s essential to align your trading preferences and security requirements with the features provided by the exchange. This careful consideration will help you choose a platform that not only meets your trading needs but also supports your investment objectives.

The Importance of Liquidity and Trading Volume

Liquidity and trading volume are critical factors when it comes to the efficiency and reliability of a crypto exchange. High liquidity ensures that trades can be executed swiftly and at prices close to the market rate, minimizing the cost of slippage and providing a better trading experience.

To assess an exchange’s liquidity, one should look at the 24-hour trading volume. For instance, an exchange managing a 24-hour trading volume of almost $300 million is indicative of robust market liquidity. This volume reflects the exchange’s ability to facilitate large trades without significant price impact.

Operational risks such as technical failures or liquidity issues can severely affect an exchange’s performance. Exchanges with high trading volumes and advanced features like leveraged tokens for spot trading are often preferred by traders seeking to amplify their trades without manual margin settings.

It’s essential to choose an exchange that combines a user-friendly interface, high liquidity, and a strong reputation to ensure a secure and seamless trading environment.

Navigating Crypto Exchange Fees and Spreads

Understanding the fee structure of a crypto exchange is essential for any trader. Fees can significantly impact the profitability of trading activities, and they vary widely among platforms. It’s important to consider not only the trading fees but also other charges such as withdrawal and deposit fees.

- Trading fees are the primary cost associated with buying and selling cryptocurrencies. These are often calculated as a percentage of the trade value.

- Conversion fees apply when exchanging one cryptocurrency for another.

- Network fees are paid to blockchain miners or validators and can fluctuate with network congestion.

To minimize fees, compare exchanges, use limit orders, leverage fee discounts, and consolidate withdrawals.

Various platforms like Coinmama, Kraken, Gemini offer lower fees than Coinbase. Binance is recommended for Asian users. For those seeking even lower fees, consider platforms like Coinbase Pro. Remember, the right exchange balances low fees with security and user experience.

Selecting the Right Crypto Exchange for Your Needs

Aligning Your Trading Goals with the Right Platform

Selecting the ideal crypto exchange is crucial for achieving your trading objectives. The right platform aligns with your investment strategy, risk tolerance, and desired level of involvement. Whether you’re a day trader seeking advanced technical analysis tools or a long-term investor needing a simple interface for periodic buys, there’s an exchange tailored to your needs.

- Day traders might prioritize exchanges with high-frequency trading support and advanced charting capabilities.

- Long-term investors often prefer platforms with straightforward purchase processes and lower fees for infrequent transactions.

- Casual traders could look for exchanges offering educational resources and community support to help guide their decisions.

It’s essential to consider the trade-off between user-friendliness and advanced features. A platform that’s too complex may discourage beginners, while one that’s too simplistic might not suffice for experienced traders.

Remember, the best exchange for one investor may not suit another. It’s about finding the balance that works for you, ensuring that the exchange’s security, fees, and supported cryptocurrencies meet your expectations.

The Registration Process: What to Expect

Embarking on the journey of cryptocurrency trading begins with the registration process on an exchange. The steps are generally straightforward, but it’s crucial to approach them with attention to detail to ensure your security and compliance with regulatory requirements.

Choose the right exchange for your trading needs by considering factors such as security, fees, and supported cryptocurrencies. Once you’ve made your selection, visit the exchange’s official website or app to start the registration process. Look for the ‘Sign Up’ or ‘Register’ button to initiate the process.

The registration process typically involves providing personal details, verifying contact information, completing identity verification (KYC), securing your account with two-factor authentication (2FA), depositing funds, and then beginning to trade.

Here’s a quick rundown of the steps you’ll encounter:

- Provide Your Details: Enter your email, phone number, and create a strong password. Additional information may be required.

- Verify Your Contact Information: Follow the instructions received via email or SMS to verify your email or phone number.

- Complete KYC Verification: Upload necessary documents like a government-issued ID for identity verification.

- Secure Your Account: Set up two-factor authentication (2FA) for enhanced security.

- Deposit Funds: Choose from available methods like bank transfer or credit card to deposit funds.

- Start Trading: With your account funded, you’re ready to dive into the world of cryptocurrency trading.

Potential Risks and How to Mitigate Them

Engaging with crypto exchanges comes with inherent risks that can impact traders of all levels. Market risks, such as the notorious price volatility and potential market manipulation, pose significant challenges. Users must be vigilant and adopt strategies to safeguard their investments.

Counterparty risks also play a crucial role, especially when considering the trust and custody aspects of centralized exchanges (CEXs) or the smart contract vulnerabilities in decentralized exchanges (DEXs). Personal security risks, including the loss of access to accounts and privacy concerns, further complicate the landscape.

To effectively mitigate these risks, it is essential to employ a combination of due diligence, robust security practices, and informed decision-making.

Operational risks like technical failures and liquidity issues, along with regulatory and legal uncertainties, add layers of complexity. By staying informed about the latest trends and regulatory changes, users can navigate these challenges more effectively. Below is a list of strategies to avoid common pitfalls:

- Conduct thorough research on exchange security measures and user reviews.

- Diversify your portfolio to minimize the impact of price volatility.

- Use hardware wallets for better control over your private keys.

- Keep abreast of legal and regulatory updates in your jurisdiction.

Comprehensive Guide to U.S. Crypto Exchanges

Why Coinbase Tops the List for U.S. Traders

Coinbase has established itself as a leader in the U.S. crypto exchange market, offering a combination of user-friendly features and robust security that appeals to a broad spectrum of traders. Its transparent fee structure and low-spread trading options make it a preferred choice for both novice and experienced investors.

- User-friendly interface ideal for beginners

- A wide selection of cryptocurrencies, including popular and niche options

- Strong regulatory compliance, enhancing trader confidence

Coinbase’s dominance in the U.S. market is further underscored by its high trading volume, which not only reflects its popularity but also contributes to its liquidity—a crucial factor for traders of all levels. While other platforms like Kraken also offer advanced trading features, Coinbase’s accessibility and ease of use remain unmatched for those starting their crypto journey.

Coinbase’s commitment to regulatory compliance and its efforts to maintain a secure trading environment set it apart from competitors and underscore its position at the forefront of the U.S. crypto exchange landscape.

Exploring the Range of Services Offered by Top Exchanges

Top crypto exchanges go beyond mere trading platforms; they offer a suite of services tailored to meet the needs of diverse investors. From margin trading to futures contracts, these platforms are designed to enhance the trading experience. Users can also participate in initial coin offerings (ICOs) or token sales, tapping into new investment opportunities.

- Supported cryptocurrencies: A wide range of digital assets for trading.

- User interface and experience: Intuitive platforms for all levels of traders.

- Liquidity: Ensures quick execution and favorable pricing.

In this rapidly evolving market, the right exchange can significantly impact your investment outcomes.

We’ve analyzed exchanges based on trading volume, security, and user satisfaction to present a comprehensive guide. These platforms stand out for their efficient order execution, competitive fees, and user-centric design, ensuring a seamless trading journey.

Methodology Behind Choosing the Best for BTC Trading

In the dynamic landscape of cryptocurrency trading, selecting the best exchange for Bitcoin (BTC) involves a comprehensive evaluation of various factors. Our methodology integrates both quantitative and qualitative assessments to ensure traders have access to platforms that not only meet but exceed their expectations.

We focused on exchanges that demonstrate high trading volume and a solid reputation within the community. The chosen platforms, including Coinbase and Kraken, are renowned for their tight spreads and efficient order execution, which are crucial for traders looking to capitalize on the volatile BTC market.

Our selection process is rooted in the belief that a great user experience and robust security measures are non-negotiable when it comes to trading BTC.

The following table summarizes the key features of some prominent exchanges:

| Exchange | Trading Volume | User Experience | Security Measures |

|---|---|---|---|

| Coinbase | High | Intuitive | Industry-leading |

| Kraken | High | Advanced | Strong |

| Binance | Very High | Comprehensive | Robust |

It’s important to align your trading goals with the right platform. Whether you prioritize reliability, global accessibility, or low fees, there’s an exchange tailored to your needs. Bitstamp, Cex, and Binance each offer unique advantages that cater to different trader profiles.

Conclusion

As we’ve explored the diverse landscape of crypto exchanges, it’s clear that the best platform is one that aligns with your individual needs and trading goals. Reddit users have highlighted the importance of security, user-friendliness, competitive fees, and a broad selection of cryptocurrencies as key factors in their decision-making process. While Coinbase emerged as a favorite for its ease of use and strong regulatory standing, other exchanges like Kraken and eToro also received praise for their unique features. Ultimately, the right exchange for you is one that not only meets your trading requirements but also instills confidence with its commitment to protecting your investments. Remember, in the fast-paced world of cryptocurrency, staying informed and choosing a reliable platform can make all the difference in your trading journey.

Frequently Asked Questions

Which crypto exchange is considered the best in the U.S.A. according to Reddit users?

Coinbase is frequently mentioned by Reddit users as the best crypto exchange in the U.S.A. due to its user-friendly interface, strong security measures, and a wide selection of cryptocurrencies.

What factors were considered in choosing the best crypto exchanges for BTC trading?

The selection was based on trading volume, exchange reputation, trading pair variety, tight spreads, efficient order execution, and user experience. Platforms like Coinbase, Uphold, Kraken, eToro, iTrustCapital, BYDFi, and Bitget were extensively tested over six months.

What should I expect during the registration process for a crypto exchange?

The registration process for a crypto exchange typically involves providing personal information, verifying identity, and setting up security features like 2FA. Each exchange may have additional specific instructions.

What are the key features to look for in a crypto exchange?

Key features include robust security with measures like 2FA and cold storage, a user-friendly interface, competitive fees, a wide range of supported cryptocurrencies, and high liquidity for efficient trading.

Why is Coinbase recommended for beginners in the U.S.A.?

Coinbase is recommended for beginners due to its straightforward interface, transparent trading fees, and a low minimum deposit requirement, making it accessible for those new to cryptocurrency trading.

How can I align my trading goals with the right crypto exchange?

To align your trading goals with the right exchange, consider factors such as the types of trading pairs offered, fee structures, platform liquidity, and the level of security provided. Choose a platform that matches your trading style and risk tolerance.