Bitcoin experienced a tumultuous week, crashing by 20% before stabilizing around $54,000 on Monday. This dramatic selloff has left many investors wondering if now is the right time to buy the dip.

Bitcoin and Ethereum Face Significant Selloffs

In the past week, both Bitcoin and Ethereum have seen their worst performances since the pandemic began. Each cryptocurrency fell over 20%, reflecting broader market turmoil. Surprisingly, despite these significant drops, cryptocurrencies have not performed as poorly as one might expect given their historical volatility.

Market Volatility and the Fear Gauge

The VIX, often referred to as the market’s fear gauge, saw its largest single-day increase in over three decades, reaching its highest level since the pandemic. This surge in volatility has intensified calls for the Federal Reserve to intervene with emergency rate cuts to stabilize the market.

Bitcoin’s Recovery Efforts

Amidst the market chaos, Bitcoin made a notable recovery attempt on Monday, climbing from below $50,000 to $54,000. This resilience is noteworthy, but the cryptocurrency’s future remains uncertain.

Analysts’ Predictions and Bitcoin’s Fair Value

JPMorgan analysts had previously indicated that Bitcoin’s price was inflated, estimating its fair value around $53,000, using gold’s volatility-adjusted price as a benchmark. Their prediction seems remarkably accurate as Bitcoin’s recent stabilization aligns closely with this valuation.

Production Costs and Market Expectations

Another critical price target to consider is $43,000, based on Bitcoin’s production costs. This target suggests that Bitcoin may not be entirely out of danger. Furthermore, market expectations are rapidly shifting. Following the recent market downturn, there is an 85% chance of a 50-basis point cut at the Fed’s next policy meeting, a significant increase from the 11% probability seen just a week prior.

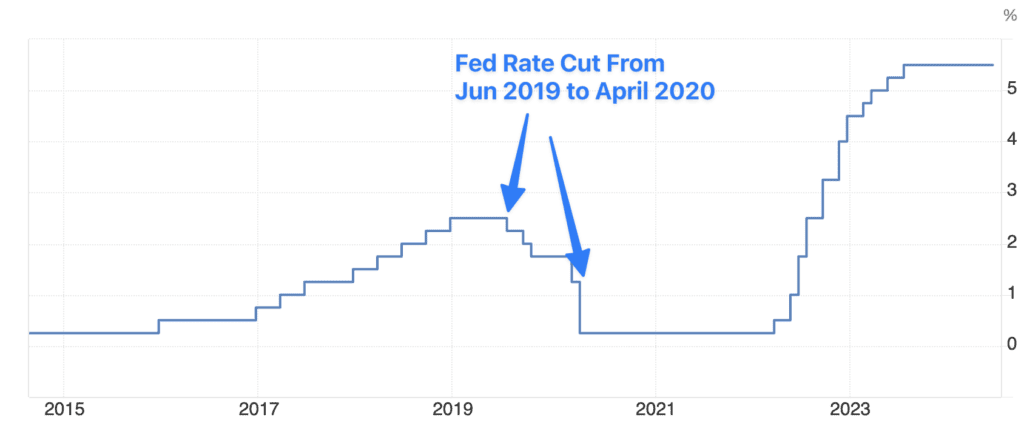

The Federal Reserve’s Influence on Bitcoin Prices

The Federal Reserve’s decisions regarding interest rates significantly impact Bitcoin’s price. A rate cut often signals concerns about the macroeconomic environment. However, it’s crucial to note that a rate cut does not necessarily guarantee a rise in cryptocurrency prices. Historical data (as shown in the following two figures) from the last interest rate cut cycle starting in June 2019 shows that Bitcoin prices declined during that period, suggesting a complex relationship between Fed policies and Bitcoin valuations.

The Impact of the U.S. Presidential Election on Markets

The recent U.S. presidential election has introduced another layer of uncertainty and potential volatility to the markets. Historically, markets experience significant fluctuations during election years, with the outcome influencing various sectors, including cryptocurrencies. It’s anticipated that the period following the inauguration of a new president could see increased market instability as new policies and economic strategies are implemented. This environment could present a long-term investment low point for cryptocurrencies like Bitcoin.

Should You Buy the Dip?

Given the current market conditions, deciding whether to buy the dip requires careful consideration. While Bitcoin’s recovery to $54,000 is promising, the broader economic factors and volatility must be taken into account. Analysts’ predictions suggest that Bitcoin’s price is aligning with its fair value, but the possibility of further declines cannot be ruled out. Additionally, the upcoming changes in the U.S. political landscape should be considered, as they might influence market dynamics in the short to medium term.

Conclusion

The recent 20% crash in Bitcoin’s value has created an opportunity for investors to potentially buy at a lower price. However, with the market’s volatility, uncertain economic conditions, and political changes, it’s crucial to approach this decision with caution. Keeping an eye on macroeconomic indicators, staying informed about market predictions, and considering the potential impact of the new U.S. administration can help make a more informed investment decision.

FAQs

What caused Bitcoin to crash by 20%?

The recent crash in Bitcoin’s value was influenced by broader market volatility, including significant drops in stock markets and increased uncertainty about economic stability.

Is Bitcoin expected to recover soon?

While Bitcoin showed some recovery on Monday, its future remains uncertain. Analysts’ predictions suggest that its price is currently near its fair value, but further volatility is possible.

Should I buy Bitcoin now?

Buying Bitcoin after a dip can be an opportunity, but it’s important to consider the broader market conditions and potential for further declines. Consulting financial advisors and staying updated on market trends is advisable.

What role does the Federal Reserve play in this situation?

The Federal Reserve’s decisions on interest rates can significantly impact market stability. There is currently a high expectation of an emergency rate cut, which could influence Bitcoin’s price and the broader market.

How accurate are analysts’ predictions about Bitcoin’s price?

Analysts at JPMorgan accurately predicted Bitcoin’s fair value around $53,000, which aligns with its recent stabilization. However, predictions can vary, and the market remains volatile.

What impact will the new U.S. president have on Bitcoin prices?

The new U.S. president’s policies and economic strategies could introduce further market volatility, potentially affecting Bitcoin prices. Historically, markets experience significant fluctuations during election years and the months following a new president’s inauguration.